Photo Source: Adobe Stock

Photo Source: Adobe StockAh, the joys of a well-deserved, extravagant summer vacation. The sand between your toes, the tropical cocktails with those tiny umbrellas, the rush of spontaneity, and the art of doing absolutely nothing! Alas, all good things must come to an end.

Now that you're back in reality, you might find your wallet feeling significantly lighter. And your bank account? Let’s not even go there. Thankfully, we have just the cure for your financial hangover.

So, sit back, kick up your feet (preferably not on a sandy beach this time), and let's talk strategy. If you’re feeling a little queasy at the thought of money, fret not! We will introduce you to 12 pain-free, possibly even enjoyable, strategies to get your finances back on track. Let’s dive right in.

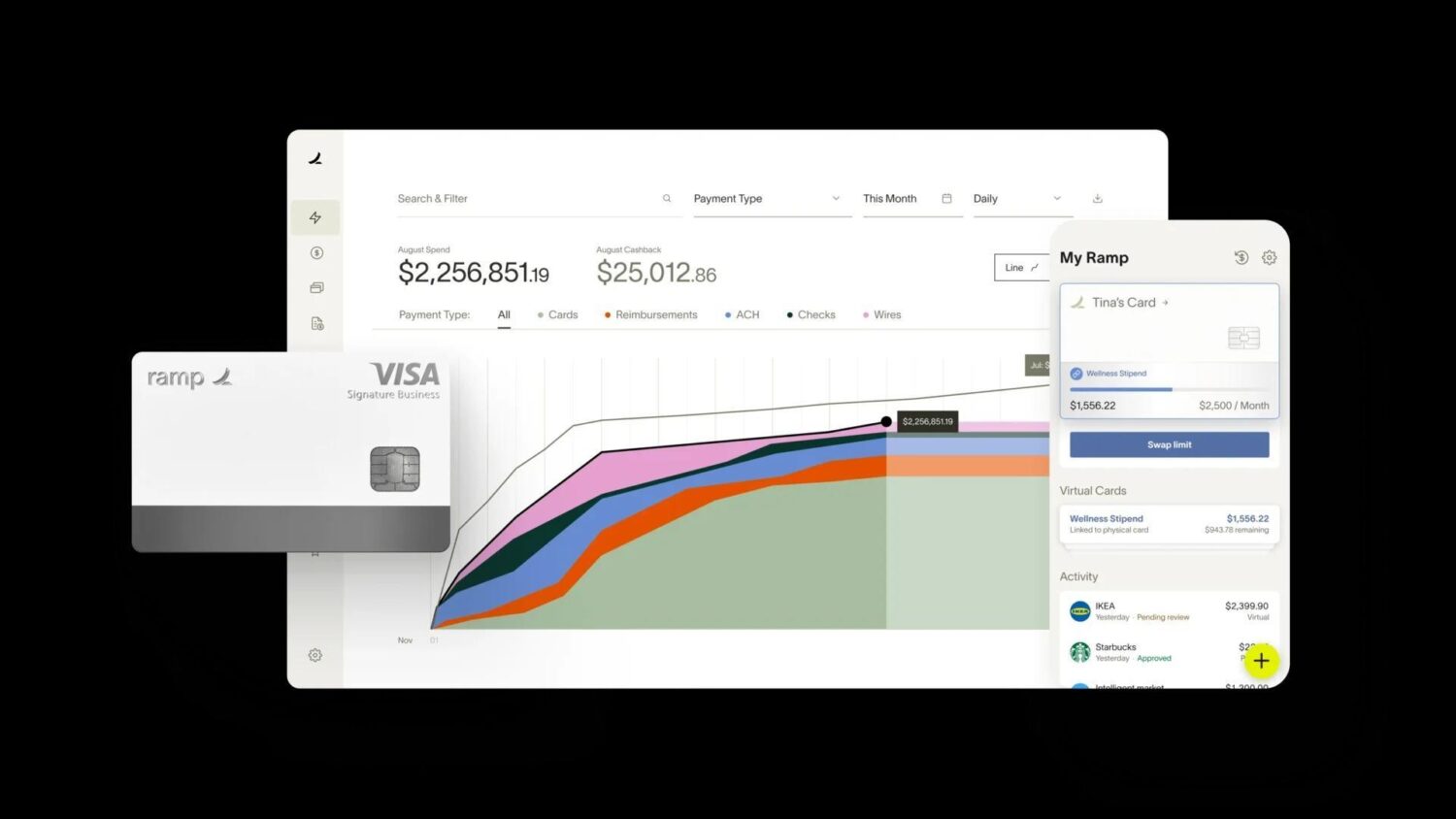

Photo Source: Ramp

Photo Source: RampBusiness credit cards with EIN only from Ramp are our little secret. Business credit cards with an Employer Identification Number (EIN) offer entrepreneurs and small business owners a valuable financial tool. Unlike personal credit cards linked to individuals, these cards are specifically designed for business expenses.

Having a business credit card with an EIN lets you keep your personal and business finances separate, providing better organization and simplifying tax reporting. These cards often come with perks and rewards tailored to business needs, such as cashback or travel rewards on business-related purchases. An EIN-based business credit card can fuel your business growth while maintaining control and flexibility over your finances.

Now, we're not encouraging frivolous purchases (remember, we're trying to recover from vacation mode), but strategic and planned spending? That’s always on the table. You’d be surprised at how much you can save, especially with rewards and cash back. It's like getting a mini vacation each time you spend!

Are your insurance payments weighing you down? Time to trim that financial fat with a little help from OTTO Quotes. Think of it like a personal trainer for your insurance. Too many people pay more than they need to for insurance, often because they don't shop around. Comparing insurance quotes is like scanning the room at a speed dating event. You want to make sure you're choosing the most compatible option that really gets you and your needs.

The OTTO platform makes it ridiculously easy to compare quotes, ensuring you're not paying a penny more than you need to. And the best part? You can do it all from the comfort of your home, in your comfy slippers, with a hot cup of tea (or a cold margarita – we don't judge). Don't let insurance premiums be a thorn in your side.

Let OTTO Quotes help you shave off those excess insurance pounds and get your financial health back into top shape.

A common business mistake is as old as time: mingling personal and business funds. Mixing the two can make a financial mess stickier than a honey pot. A separate business bank account is the magical key to financial clarity, and it can turn out to be your pot of gold at the end of the rainbow.

Thankfully, Entrepreneur can shed a little light on the best business bank accounts available now. These aren’t just any old business bank accounts — they can be a real financial game-changer.

This is how to help your business transactions stay as organized as a librarian's bookshelf and your money management as smooth as a freshly paved road. Financial blurring can stay a relic of the past, and you? You can march forward, confident and clear-headed, with these recommendations from Entrepreneur.

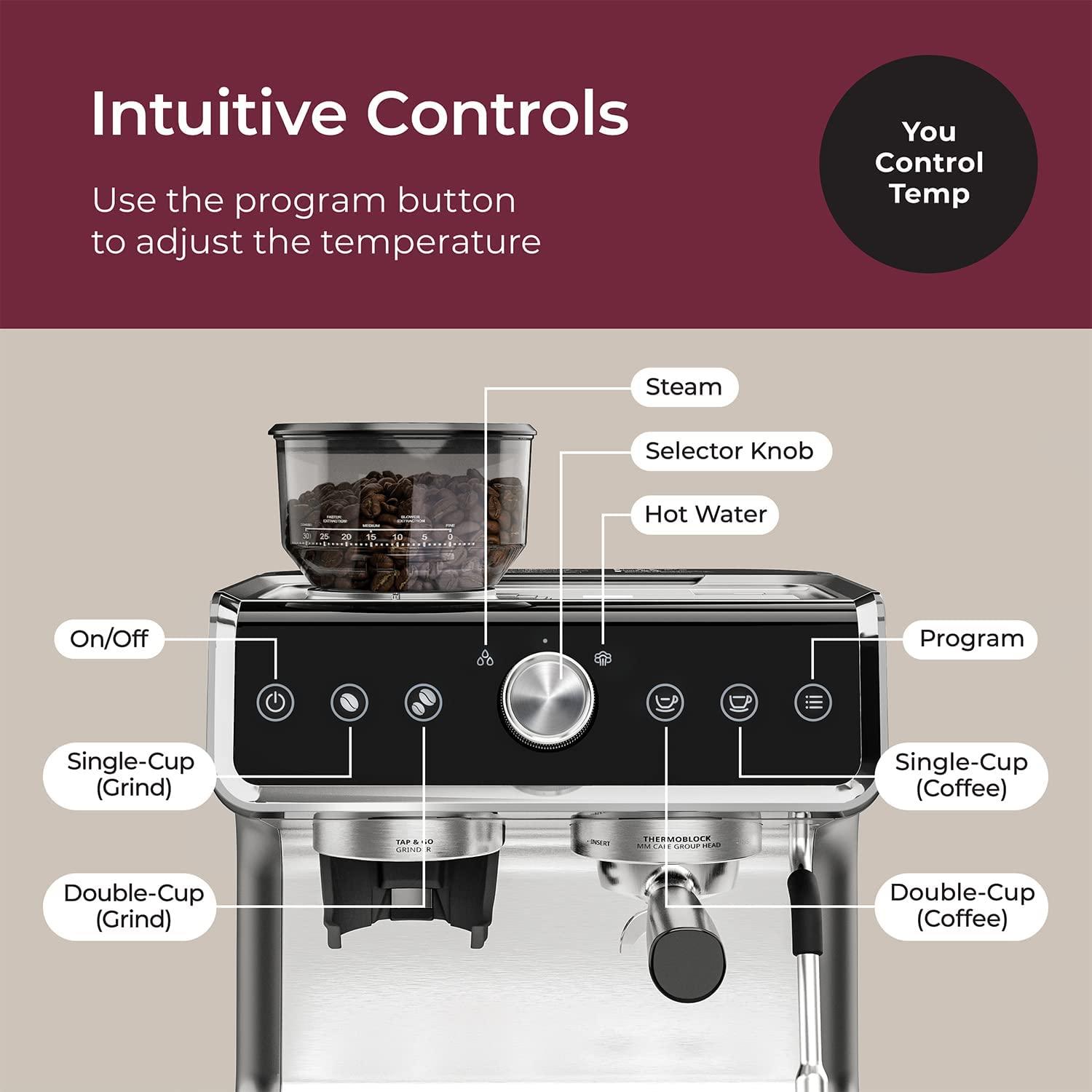

Photo Source: Mueller

Photo Source: MuellerThere's nothing quite like the aroma of freshly brewed espresso in the morning. But those daily coffee shop visits? They add up quicker than a squirrel collecting nuts for winter. What if we could bring the barista experience home and save you a neat little packet along the way?

This Mueller espresso machine is your ticket to gourmet coffee without the gourmet price tag. Imagine rolling out of bed and straight into your personal cafe. It's all about the little luxuries in life, and you get to savor the joy of a rich espresso at home and watch your savings stack up like a perfectly pulled shot.

Because financial responsibility doesn't mean giving up the things you love – it just means brewing them smarter with Mueller.

Ever feel like the royalty of your own kingdom, a landlord perhaps? Now that's a great way to rake in some cash! But alas, just as every kingdom has its challenges, so does the realm of renting. What if I told you there's an easy way to rule your rental roost and cover your assets? Welcome to the kingdom of landlord insurance.

Landlord insurance is a specialized insurance policy that provides coverage for property owners who rent out their properties. It typically includes protection for the property's physical structure, such as the building itself, against perils like fire, vandalism, or natural disasters. Additionally, it can offer liability coverage, safeguarding landlords against potential lawsuits from tenants or third parties who may be injured on the property.

Steadily can play the trusted knight in shining armor, potentially reducing your landlord insurance cost. Your property doesn't just become a source of income but also a fortress of financial stability. Now, you can sit back on your metaphorical throne, collect rent, and rest easy knowing Steadily has got your castle covered.

Are mortgage payments giving you sleepless nights? Don't let your home become a financial burden. When the going gets tough, it's time to start looking to Balance for mortgage help. They specialize in guiding homeowners through the maze of mortgage options, providing expert advice and support.

With Balance, you don't have to face the mortgage monster alone. They'll help you explore co-ownership strategies to lower your monthly payments, refinance your loan, or even find financial assistance programs. Most importantly, you can access equity in your home when you need it most.

It's like having a trusty financial ally by your side, fighting to help you regain control of your home and your finances. Don't let your mortgage weigh you down. Let Balance be the hero you need.

Photo Source: Power Wizard

Photo Source: Power Wizard

Do you ever feel like you're paying way too much for your electricity bills? It's time to shed some light on a brighter, more cost-effective solution. Enter Power Wizard and its unique approach to energy plans.

Switching to a better electricity plan can significantly affect your monthly expenses. Power Wizard offers a range of plans designed to suit various lifestyles and budgets. Whether it's green energy options, fixed-rate plans, or flexible payment options, they've got you covered.

With Power Wizard, you can keep your home powered up without feeling like you're getting zapped by high bills. It's time to bring some enlightenment to your financial situation with these electricity plans.

They say gold is the ultimate symbol of wealth and stability. If you're looking to fortify your financial future, it's time to consider a gold IRA. And when it comes to precious metal investing, American Hartford Gold is your trusted gold IRA partner.

A gold IRA offers you the opportunity to diversify your investment portfolio and safeguard against economic uncertainties. American Hartford Gold specializes in providing secure and reliable IRA services, helping you navigate the complexities of investing in precious metals.

With their expertise, you can confidently add the shine of gold to your retirement savings strategy. So, don't just settle for the ordinary – aim for gold and secure a glittering future.

Photo Source: MPOWER

Photo Source: MPOWERAre student loan payments weighing you down like a backpack filled with bricks? It's time to shed that financial burden and start your journey toward financial freedom. Enter MPOWER, your go-to student loan help service.

Securing a student loan without cosigner help can be challenging, but it's not impossible with MPOWER. Some lenders offer loans specifically designed for borrowers without a cosigner. When determining eligibility, these loans typically consider factors like credit history, income, and academic performance.

MPOWER understands the struggles of student loan debt and offers expert guidance to help you navigate through the complexities. They can assist you in exploring options such as loan refinancing, income-driven repayment plans, or even loan forgiveness programs.

With their support, you can create a personalized plan to lighten the load and make your student loan journey more manageable. Don't let student loans hold you back from achieving your financial goals.

Curious about the world of stock trading but unsure where to begin? Get ready to embrace the power of artificial intelligence with the Pluto AI stock trading platform.

AI has revolutionized how we trade stocks, making them more accessible and efficient.

With Pluto, you can tap into the benefits of AI technology to make smarter investment decisions. Their platform analyzes market trends, predicts stock movements, and provides valuable insights to guide your trading strategy.

Whether you're a seasoned trader or a novice, this service empowers you to trade like a pro and potentially unlock new opportunities for financial growth. So, let AI be your secret weapon in the stock market game, and let Pluto be your trusted ally along the way.

Budgeting: the word alone can make some people cringe. But what if budgeting could be as enjoyable as a day at the amusement park? Get ready to turn your finances into a thrilling rollercoaster ride with the Simplifi budgeting app.

This app transforms the daunting task of budgeting into a fun and interactive experience. Say goodbye to complicated spreadsheets and hello to colorful charts, personalized goals, and expense tracking at your fingertips. With intuitive features and user-friendly interfaces, Simplifi helps you take control of your finances with ease. From setting saving targets to tracking your expenses, their app becomes your trusty companion on the financial adventure.

Buckle up and embark on an exciting, engaging, and, most importantly, effective budgeting journey.

Let's talk about everyone's favorite topic: groceries! We all need to eat, but the cost of groceries can quickly add up. That's where Boxed, the ultimate bulk-buying website for groceries and supplies, comes in.

You can unlock substantial savings and stretch your grocery budget further by purchasing in bulk. Boxed offers a wide range of products at wholesale prices, from pantry staples to household essentials. Stock up on your favorite items, and watch your savings pile up like a tower of canned goods.

Say goodbye to frequent trips to the store and hello to convenience and value. It's time to supercharge your grocery shopping and make every dollar count.

Congratulations! You've made it through our whirlwind tour of 12 savvy strategies to get your finances back on track. From business credit cards to budgeting apps, we've covered a range of tools and services that can make a real difference in your financial journey. Remember, regaining control of your finances is a process that starts with small steps and smart choices.

Whether you're reigning as the leader of your landlord empire or sipping espresso from your home, rest easy knowing these solutions can help you bounce back from that post-summer splurge.

Advertising disclosure: We may receive compensation for some of the links in our stories. Thank you for supporting LA Weekly and our advertisers.