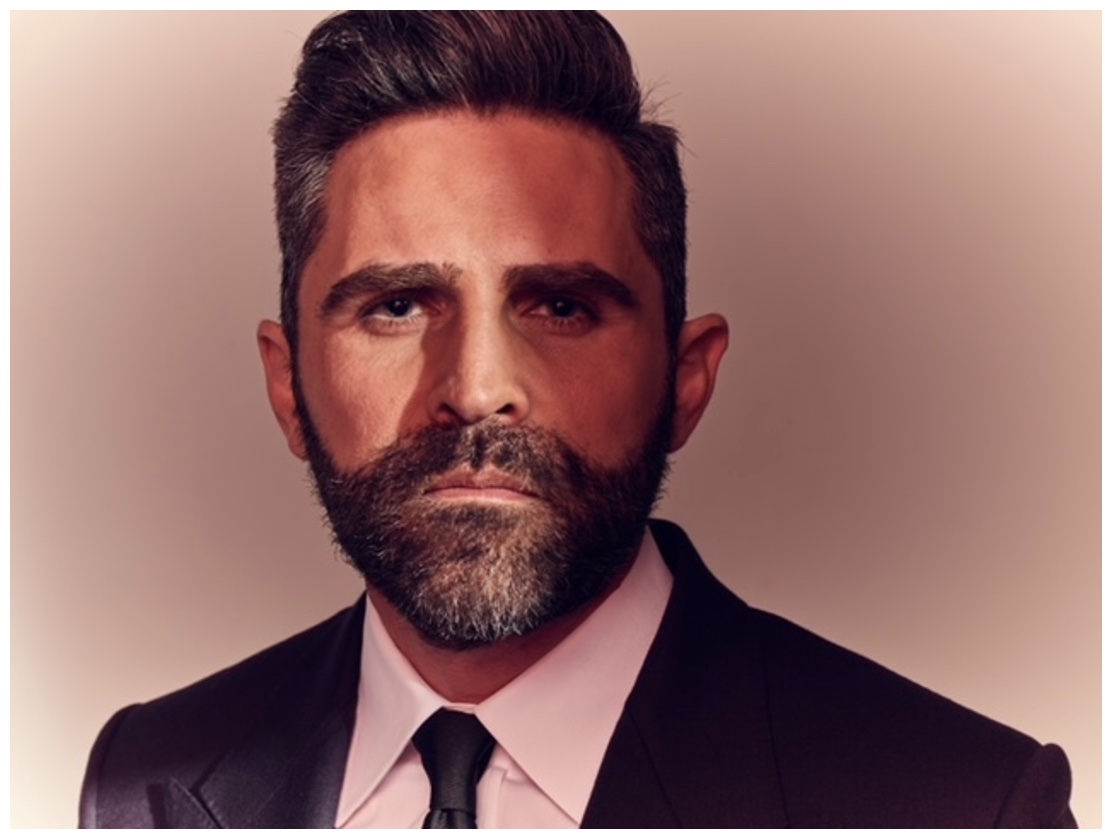

People often buy into the myth that billionaires are born into their wealth or blessed with one lucky idea. But some billionaires — Steve Jobs, Bill Gates, and Mark Zuckerberg included — would beg to differ. Ari Rastegar, founder and CEO of the Rastegar Property Company, who is well on his way to putting himself in that conversation, is no different.

In this article, we will be spotlighting one of the brightest minds in real estate and showcase the diligence, calculated risk, failure, and persistence that has helped him reach the heights of his profession.

When asked what it takes to become a billionaire, Rastegar remarked, "The number one thing, if you want to become a billionaire, is you need to solve a billion-dollar problem." As many entrepreneurs have discovered over the course of history, it’s important to analyze the marketplace, find something that isn’t working or isn’t working the way that it should, and fix it.

“You need to find an inefficiency in the marketplace; a product, a creation, a service that touches and helps so many people that it could generate billions of dollars of revenue and is helping people in a billion dollar capacity,” Rastegar says. “That, by itself, is the natural iteration to becoming a billionaire.”

According to Josh Answers, host of The Trading Fraternity and The Stock Market Live, another important attribute that sets billionaires apart is their willingness to take risks. "Whether it’s in the stock market or through their business ventures, billionaires take calculated risks," he observes. "However, when I say calculated, I mean extremely calculated. They carefully weigh every potential risk and reward before making a decision."

While risk-taking is critical to reaching the elusive “B” status, billionaires thoroughly investigate the risks they take, never take on too much risk at once, and always diversify their investments to safeguard against losses. Becoming a billionaire does not involve a game of financial roulette; billionaires have clear financial plans, detailed budgets, and well-defined roadmaps for the future.

No matter how billionaires calculate risks and plan strategies, failure is a statistical inevitability. In the latter half of 2022, Rastegar released his book, “The Gift of Failure: Turn My Missteps Into Your Epic Success,” which is a testament to the belief that your failures are not finalities, but opportunities to realize your dreams. Rastegar did not start at the top of his profession — he began with delivering pizzas at DoubleDave’s — but through his experiences, he would soon become the “Oracle of Austin” and take the real estate industry by storm.

“Never let defeat fool you into thinking that it's permanent,” Rastegar says. “Keep going. Don't ever stop or the chances of you reaching the elusive ‘B’ status is effectively impossible.”

Like Rastegar, Rudy Mawer, CEO of Mawer Capital, advises anyone on the path to billionaire status to expect failure and move on quickly. Learning to take failure in stride means a good chance of a rebound.

"When failure occurs early on in your career, it can seem like the worst thing in the world," Mawer acknowledges, "but defeat and failure are a part of the process, and billionaires build resilience through that process like steel in a forge. Most people get knocked out after being hit a couple of times. Billionaires focus on their ‘why’ and don't even feel those punches."

As mentioned above, Rastegar says that to become a billionaire, you have to solve a billion-dollar problem. Effectively, you cannot expect money to fall into your lap; you have to make something worth that money.

"Think about the things that irritate you during your daily routine. How could you solve those problems? Would a lot of people benefit from your solution? These are the questions that generate billions," according to the real estate mogul.

For example, when Rastegar set out to design a real-estate firm, the business he created was different than any other in the industry. Financial advisors wanted to make money from them, rather than for them, so he became the best at employing an "investor's first" strategy focused on recession-resilient commercial property.

Rastegar’s solution offered investors of all sizes access to institutional-grade deals usually reserved for larger investors. That solution enabled Rastegar to gain portfolio experience in 13 states, 38 cities, and over 3.5 million square feet of real estate development.

Justin Draplin, who specializes in tiny homes as founder and CEO of Eclipse Cottages, says a billion-dollar solution is just part of the equation. He reiterates that billionaires hustle to stand out in crowded niches.

"Most people don't realize how difficult real estate can be," Draplin remarks. "The space is flooded with get-rich-quick schemes and fake mentors who are all hype. Most people become discouraged when they realize the work it takes to build up their success."

Admittedly, today's economic climate is not ideal for spawning a new crop of billionaires. Dr. Richard Michaud, the author of "Finance's Wrong Turns, A New Foundation for Financial Markets, Asset Management, and Social Science", admits the previous year's investment performance proved challenging for traditional investors. Instead of giving up, he advises serious investors to look at the potential benefits.

"Times like these offer valuable insights into capital markets and the global economy," Dr. Michaud says. "This is a time to determine where weaknesses occurred and how we can add value moving forward. You can learn a lot when a good model goes off track."

In addition, despite the economic climate being less than ideal at the moment, what sets billionaires apart from others is their mindset. They do not settle for traditional methods of creating wealth. As Rastegar smartly points out, billionaires are always all in.

“The traditional ways that individuals work to prepare for retirement are fundamentally different psychological and mechanical traits from what build billionaires and/or entrepreneurs,” Rastegar says. “To become a billionaire, certainly a self-made billionaire, you need to be all-in on everything all the time because any type of "plan b" is almost certainly putting you at a place of certain failure. It is all in, all the time.”

Advertising disclosure: We may receive compensation for some of the links in our stories. Thank you for supporting LA Weekly and our advertisers.